Accounting Services of 2024

Accounting software is a business tool that automates and streamlines accounting tasks like bookkeeping, invoicing, payroll, and tax preparation. It offers benefits such as increased efficiency, better financial visibility, time savings, and improved cash flow management. The cost of accounting software can range from free to hundreds of dollars per month, with most providers aiming for user-friendliness and ease of use. When choosing accounting software, it's important to consider factors like business size, tasks to automate, budget, company culture, and provider support.

FreshBooks

- Invoicing

- Expense Tracking

- Time Tracking

- Project Management & Collaboration

- Estimates

- Payments

- Accounting

- Reporting

FreshBooks is an intuitive web-based invoicing and accounting software. It is an all-in-one cloud service that offers financial tools for anyone seeking organization in their small business.

FreshBooks Cloud Accounting has many features for use across your business. Check out the latest time management details between your team while transferring it into an easy to read invoice. Get straightforward information about your costs with built-in expense reports. Finally, views tons of different reports about the health of your business on your custom dashboard.

Wave financial software is a simple and secure way to manage your business financials including accounting, invoicing, payments, payroll and receipts. Get started in seconds thanks to Wave's browser-based technology. Access your accounting information from anywhere you have a browser and an internet connection.

50Cloud Accounting

- Track Business Finances

- Invoice Customers

- Accept Payments

- Manage Inventory

If you have a small business that has grown to the point of needing a dedicated accounting department, Sage wants 50cloud Accounting to provide the software service it uses. The app brings together the accounting tools needed to manage a business's finances. You can track transactions, invoice customers, receive payments, and prepare taxes with this product. Sage also provides deep integration of Microsoft Office 365 with its accounting software.

Cloud Accounting

- Create Invoices

- Pull Data from Existing Financial Accounts

- Track Inventory Levels

- Access from Mobile Devices

If your business needs streamlined and full-featured book-keeping software that supports mobile devices, Sage Business Cloud Accounting is an affordable option. It provides the book-keeping records, modern electronic invoicing features, and real-time reporting that small businesses need to compete in today's marketplace. The automation features also make it possible for one person to handle the accounting of most small businesses.

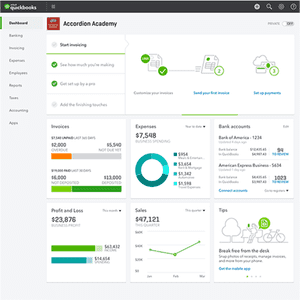

Quickbooks Online

- Track Income and Expenses

- Send Invoices

- Maximize Tax Deductions

- Organize Receipts

- Manage Bills

- Connect to Third-Party Apps

QuickBooks Online brings Intuit's award-winning bookkeeping software to the cloud, making it available to customers wherever they have internet access. Intuit also offers access to QuickBooks Online using mobile apps.

QuickBooks includes a comprehensive set of features for businesses, whether they are small retail stores, creative freelancers, or ecommerce startups. It helps managers track time, organize receipts, track mileage, create invoices, and manage bills. At the end of the year, these features make calculating tax deductions as simple as running a report.

QuickBooks Online also offers features for larger businesses, too, like inventory tracking, currency conversions, and multiple user accounts.

Quickbooks Pro

- Track Income and Expenses

- Maximize Tax Deductions

- Invoices and Payments

- Run Reports

- Create Estimates

- Track Sales and Sales Tax

- Manage Bills

- Handle Payroll

QuickBooks Pro is the desktop application version of Intuit's versatile business accounting software. Designed for small-to-medium businesses, QuickBooks Pro brings together a comprehensive set of expense and income tracking features as well as a tax preparation module. For an additional charge, you can also add payroll to QuickBooks Pro to make it a complete accounting solution. If internet connectivity is a security or technical issue, QuickBooks Pro is the best alternative to Intuit's online application.

Why do I need Accounting software?

## Accounting Software

Accounting software is a type of business software designed to automate and streamline various accounting tasks, such as bookkeeping, invoicing, payroll, and tax preparation. With accounting software, businesses can reduce manual workload, minimize errors, and gain better visibility into their financial health.

## Why do I need accounting software?

Accounting software offers several key benefits, including:

* Increased efficiency and accuracy in accounting tasks

* Better financial visibility and reporting

* Time savings on manual tasks and data entry

* Improved cash flow management

## Price range

The cost of accounting software can range from free to several hundreds of dollars per month, depending on the features and level of support you need. Some providers offer free plans with basic features, while others offer enterprise-level solutions for large businesses.

## Ease of use

Most accounting software providers aim to make their products user-friendly and accessible to users of all skill levels. Many offer intuitive interfaces and streamlined workflows to ensure a smooth experience for all users. Some providers also offer training and support resources to help users get up to speed quickly.

## How to choose the right accounting software provider

When choosing accounting software, it is important to consider several key factors, including:

* The size and complexity of your business

* The specific accounting tasks you need to automate

* Your budget

* Your company's culture and preferences

* The level of support and training offered by the provider

Consider these factors and weigh them against the features and benefits offered by different providers to find the best fit for your business.