Quickbooks Pro

starstarstarstarstar_half

Comprehensive Accounting Program

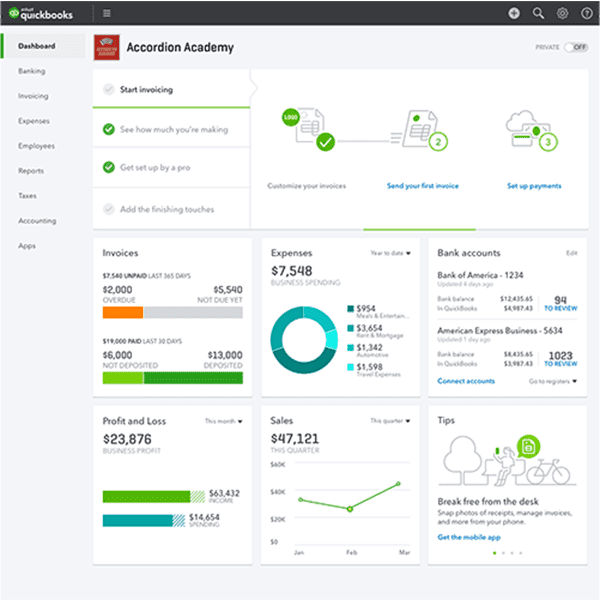

QuickBooks Pro is Intuit's Windows desktop small business accounting solution. It tracks income and expenses, generates invoices, aids tax preparation, and imports transactions from online financial accounts.

QuickBooks Pro combines a host of features to create a comprehensive accounting program for small businesses and self-employed professionals. The highlights include tracking income and expenses, maximizing tax deductions, invoicing and payments, reports, quotes and estimates, sales and sales tax, managing bills, and payroll.

Try Quickbooks Pro free for 30 days.

Start my free trialAggregate Rating = 4.5/5starstarstarstarstar_half

Based on 0 reviews from 0 sources

Quickbooks Pro features:

Intuit

Intuit specializes in accounting and tax preparation. Millions of businesses and individuals utilize Intuit software, such as QuickBooks and TurboTax, to manage personal finances and business accounts. Intuit is also an industry leader in tax preparation.

Plans and Pricing

Quickbooks Desktop Pro (1 user)

$29/mo

Plan Details

- Plans include the full version of the desktop application. You can also bundle Intuit's payroll feature with QuickBooks Pro for an additional fee.

- 1 User + Payroll: $66/mo

Quickbooks Desktop Pro (3 users)

$61/mo

Plan Details

- Plans include the full version of the desktop application. You can also bundle Intuit's payroll feature with QuickBooks Pro for an additional fee.

- 3 Users + Payroll: $99/mo

Categories

Track Income and Expenses

attach_moneyQuickBooks Pro gives you the insights you need to manage a business's finances. It can connect to your financial accounts over the internet and import transactions, which it automatically sorts into relevant categories. QuickBooks comes with an insightful set of standard income and expense categories, and you can create custom categories unique to your business.

Maximize Tax Deductions

check_circle_outlineTax season doesn't have to be stressful when you have accounting software like QuickBooks Pro backing you up. It'll sort your expenses into deductible categories and generate reports you can use to file. You also can share your data with a tax accountant.

Invoices and Payments

paymentsQuickBooks Pro generates smart invoices that your clients and customer can pay electronically when they receive them by email. The links included with a QuickBooks invoice take them to a payment page where they can complete the transaction. QuickBooks then records the transactions and deposits the funds into your account.

Run Reports

pollThe reporting dashboard included in QuickBooks Pro provides you with an essential overview of your business's finances. You can quickly see your cash flow, revenues, profit and loss, and debts at a glance. QuickBooks also lets your publish professional financial reports suitable for business meetings and sharing with business partners or accountants.

Create Estimates

thumb_upQuickBooks Pro leverages the same invoicing features to generate initial estimates for prospective customers. You can pull in product pricing from inventory records and billable hours from QuickBooks's time tracking to generate quotes with minimal data entry. If the prospect accepts the estimate, QuickBooks converts the estimate into an invoice for billing.

Track Sales and Sales Tax

track_changesQuickBooks Pro takes sales support to the next level by offering payment processing services. When you receive payments through Intuit's service, they're automatically recorded in your transactions. QuickBooks Pro will handle calculating applicable sales tax and help you remit the taxes you've set aside.

Manage Bills

check_boxQuickBooks Pro also gives you bill scheduling and reminder tools that will keep you in good standing with your vendors. Once you've created recurring bills, they're added to a calendar and tracked until paid. QuickBooks can print checks drawn against your financial accounts to pay bills from inside the application, too.

Handle Payroll

account_balancePayroll is an additional feature that you can add to QuickBooks Pro. You can import timesheet data for employees along with benefits information to generate paychecks with calculated withholdings. Small businesses can save money with this feature that would otherwise be spent on payroll outsourcing or additional software tools.