QuickBooks Payroll

starstarstarstar_halfstar_border

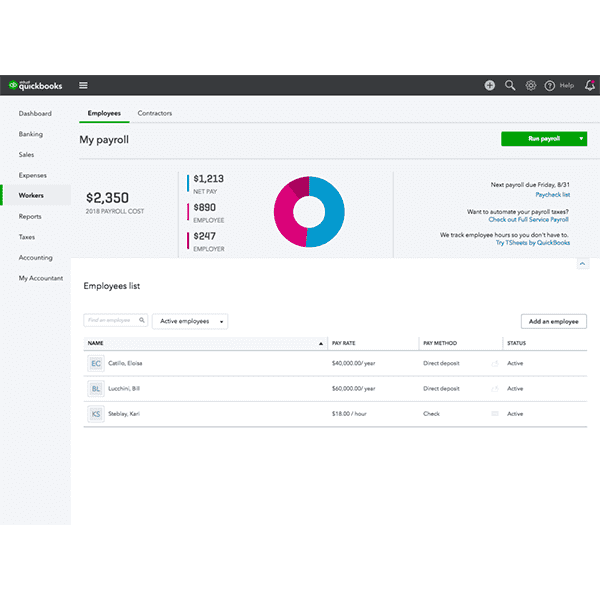

Pay processing solution for small businesses.

QuickBooks Payroll is a pay processing solution for small businesses. The self-service option offers calculation of employee paychecks, free direct deposit, and automatic tax with up-to-date state and federal tax rates. The full-service option adds start-to-finish tax filing, assisted setup, and expert support.

Try QuickBooks Payroll free for 30 days.

Start my free trialAggregate Rating = 3.5/5starstarstarstar_halfstar_border

Based on 0 reviews from 0 sources

Quickbooks Payroll features:

Intuit

Intuit specializes in accounting and tax preparation. Millions of businesses and individuals utilize Intuit software, such as QuickBooks and TurboTax, to manage personal finances and business accounts. Intuit is also an industry leader in tax preparation.

Plans and Pricing

Self-Service Payroll

$35 per month base, plus $4 per employee per month

Plan Details

- 24-hour direct deposit, calculate employee paychecks, calculate and file year-end forms, & unlimited payroll runs.

- QuickBooks' Self-Service solution is a great option for small businesses with a little bit of accounting know-how or few employees. This dependable software helps you prepare your paychecks and labor reporting easily and consistently. You are free to file taxes on your own or use an outside accountant.

Full-Service Payroll

$80 per month base, plus $4 per employee per month

Plan Details

- Start-to-finish payroll taxes, same day direct deposit, W-2s filed and sent for free, & assisted payroll setup.

- In addition, Full-Service Payroll offers a No Penalty Guarantee. Intuit will resolve payroll tax filing errors and represent you with the IRS if any issues arise. This service is a great choice for business owners who want a more comprehensive solution and don't want to worry about tax preparation headaches.

Categories

Payroll Simplicity

account_balanceQuickBooks offers simple, powerful payroll solutions to business owners. With either self- or full-service, processing payroll for your workforce is fast and easy. Their plans and pricing are straightforward with clearly defined features, so you’re only paying for the support and services that you need.

Keeping you Up-to-Date

thumb_upThe program keeps track of any changes to local and national taxes so you don’t have to worry about having out-of-date information. The full-service plan provides comprehensive tax filing, including support for any filing errors or issues that arise with the IRS.

Save Time and Money

hourglass_fullYou’ll save time and money processing payroll with QuickBooks, which allows you to do a payroll run in as little as five minutes once your workforce is set up in the system. Managers reported that they were able to reduce the time eaten up by payroll by an average of 10 hours per month.

Employee Access

important_devicesYour employees will get fast, reliable direct deposit and access to paystubs and W-2s on-demand through the online portal. Easy and transparent communication about compensation increases satisfaction and eliminates many common frustrations for you and your employees.

Provide Learning Resources

live_helpIntuit does not hide their expertise behind expensive service contracts or secretive practices. They provide tutorials, resources, and webinars for business owners to learn about payroll, taxes, hiring, and more important topics so you can grow your business right.